Determine if they include an Inventory Part.

Check the unapplied credit memos and open invoices.A credit memo or invoice that includes an item associated with an account on the balance sheet can affect A/R on both the cash basis balance sheet and accrual. Determine if a specific line item points to an account within the balance sheet. You might still have to go in and manually adjust the balance in the A/P or A/R. *It is important to note that if a Cash Basis Balance Sheet does show a balance in A/P or A/R it may not be enough to determine the cause. Normally, there wouldn’t be a balance in A/P or A/R on a Cash Basis Balance Sheet, but if one does occur it is most likely due to one of the following situations:

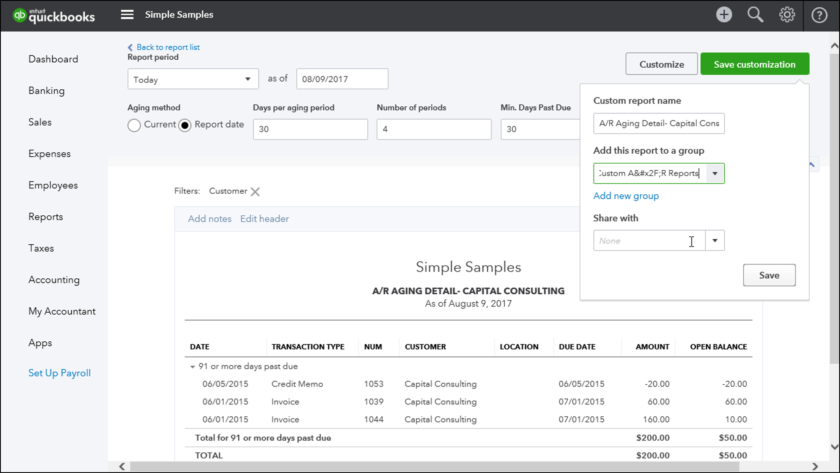

This means that any unpaid bills will be removed from the P&L and Cash Basis Balance Sheets as long as the bill’s coding is to an income or expense account. This also happens with unpaid bills except in that instance Accounts Payable and expenses are involved. Similarly, QuickBooks also reduces Accounts Receivable on the Cash Basis Balance Sheet by the total amount of open Invoices that have items associated with expense or income accounts. It also adds the total receipts to income against any invoices from previous years. QuickBooks doesn’t include open invoices using items associated with expense or income accounts from the total income on the cash basis P & L Report. Understanding the way Cash Basis Reports are Calculated

Managing out of pocket cash expenses in quickbooks pro how to#

How Bills and Partially Paid Invoices affect Cash Basis Reportsīefore we dive into each of the common problem areas we will also quickly go over how to make changes to your reporting preferences for cash basis.Tips and Tricks for Making the Cash Basis Conversion.Proofing A/P and A/R within Cash Basis Reports.Troubleshooting for Cash Basis Balance Sheets that are Off Balance.Limits of QuickBooks Cash Basis Reports.However, there are a few nuances that can cause the cash basis report to show incorrect information. It will also add expenses and income from the previous year that were paid or received in the current year. In the simplest explanation, QuickBooks makes Accrual to Cash conversions by removing unpaid expenses and unreceived income from your reports. This is why it is important that you understand how QuickBooks makes their conversions. It is important to note that the conversion can sometimes lead to inaccurate numbers that can be somewhat troubling. It also doesn’t mean that QuickBooks stores two different sets of books instead, to help you with keeping a cash basis financial statement, QuickBooks does its best to make the Accrual to Cash Basis conversion. This means that QuickBooks will allow you to use accrual basis reports for management information throughout the year and you can also use cash basis reports when preparing taxes. One of the very best features in QuickBooks is the fact that it doesn’t force you to use just the Cash or Accrual Basis. We will use this article to discuss using cash basis reports in QuickBooks.

0 kommentar(er)

0 kommentar(er)